You are familiar with the emotion when the refrigerator seems to be bare, but payday is far away. Being single mums, you are combating bills as you attempt to keep the little ones content. There may also be hard gaps in your salary before the end of the month.

Single mothers earnings are elsewhere being stretched out a bit with every price increment on your side. The pair of school uniforms that was worn last time now requires replacement too soon. Cash is low, and you must have actual solutions and not money pitfalls.

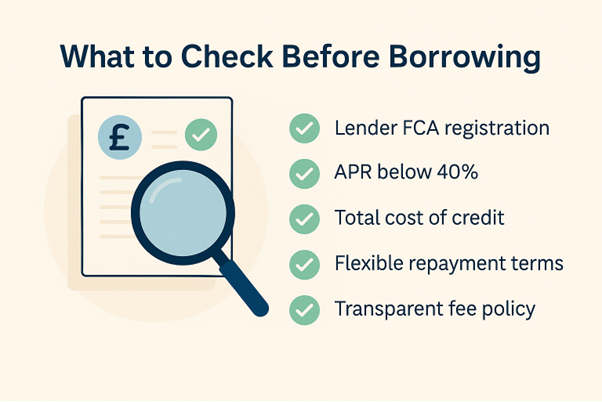

Seeking secure loans for single moms is like searching for gold in dirty waters. There are good opportunities available, provided you know where to find them. You must get decent charges and good-natured terms when in a tight spot. This is a roadmap to improved loan determinations.

Common Money Challenges Faced by Single Moms

Life as a single mom brings unique money struggles you face each day. You often find your bank account empty when unexpected costs appear suddenly. Your paycheck barely covers food, school items, and childcare costs each month.

Rent and energy bills might leave you with almost nothing left over. You sometimes must choose between paying for heat and buying food. Your credit score takes hits when bills pile up beyond reach.

Many mainstream banks see your solo income and quickly say no. You feel stuck between bad choices when cash runs short suddenly. The mental weight of money worries follows you through sleepless nights. School trips and uniform costs create extra budget strain throughout terms. Child support payments may arrive late or sometimes not at all.

Health issues can pop up without warning, adding more financial pressure. Transport costs add up when taking kids to school each day. Working part-time jobs means your income changes from week to week. School holidays force tough choices about work versus childcare needs.

Affordable Loan Options Available for Single mothers

You have better options than costly payday loans with huge fees. Your local council might offer crisis loans with zero interest rates. These small single parent loans help bridge gaps when you face tough weeks.

- Credit unions examine your entire situation rather than just cold numbers. You can join an established group based on where you live or your job.

- Some online lenders now offer fair rates with clear payment terms. You can look for the APR figure before you sign up for any loan.

- You can ask about budgeting advances for needs if you get Universal Credit. These help buy home items or pay deposits for new flats. You pay back small amounts from future UC payments over time.

- The UK Social Fund provides loans for basic household goods too. Many local groups offer grants that never need to be paid back.

- Family charities sometimes give cash help during tough money patches. Turn2us can show you benefits you might not know about. The Family Fund gives special help when children have extra needs. You make sure monthly payments fit what you can afford.

- You can get free money advice from your local Citizens Advice office. The Money Helper service offers phone guidance at no cost. They can help you find lenders who can give emergency loans for a single mother. Some church funds provide interest-free loans in your area. You can ask your employer if they offer salary advances when you’re stuck.

| Government and Benefit-Based Loan Help for Single Parents | |||

| Scheme | Who Can Apply | Interest | Repayment Period |

| Budgeting Loan (DWP) | On certain benefits | 0% | 2 years |

| Budgeting Advance (Universal Credit) | UC claimants only | 0% | 12–24 months |

| Childcare Grant | Studying single parents | N/A (Grant) | No repayment |

| Sure Start Maternity Grant | Pregnant women/first child | N/A (Grant) | No repayment |

| Local Welfare Assistance | Low-income families | Depends on the council | Varies |

How to Qualify for Low-Interest Loans?

You can find loans with low rates. The loan firms want to see that you can pay them back. With a few smart steps, you’ll boost your chances right away.

- Step 1: Show your steady money coming in each month. Keep payslips from the last three months in a safe place. Print bank statements that show your wages going in on time. Self-employed? Have your tax returns and client payment proof ready. Even part-time work builds trust with careful record-keeping.

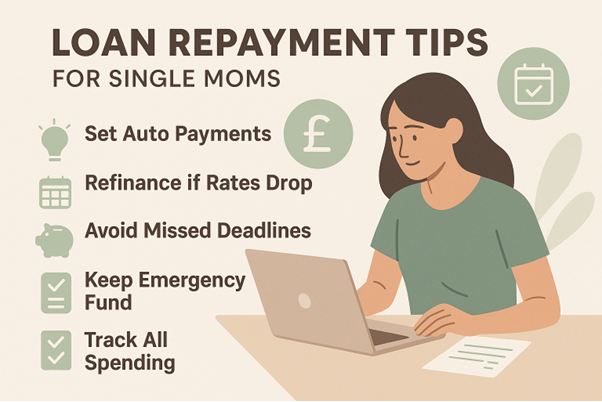

- Step 2: Pay your bills on time to build trust points. You set up direct debits for gas, power, and phone bills. Your on-time payment helps fix past credit bumps and bruises. You can check your credit file for free to spot any wrong marks.

- Step 3: You can ask for just what you need, not more. Your £500 loan request looks safer than asking for £2,000. This makes “yes” more likely and keeps your payback stress low.

- Step 4: Don’t hide your child’s benefits or tax credits. These count as real income to many fair lenders now. Universal Credit, Child Benefit, and other state help provide steady cash. You can keep award letters and payment proof from the DWP handy.

- Step 5: Shop around before you fill out any forms. Some online lenders now focus just on helping parents and give loans for bad credit as well.

Benefits of Using Direct Lenders

The direct lenders offer clear paths to loans without the maze of middlemen. You talk straight to the money source with less fuss. Direct lenders know this and keep things moving along quickly.

Fast Decisions and Few Checks

You’ll get answers within hours instead of waiting whole weeks. Many direct lenders check more than just cold credit scores. They look at your whole money picture with fresh eyes. Your past troubles won’t always block you from getting help now. Online forms take minutes rather than the stack of papers banks want. Some direct lenders give same-day cash when you’re truly stuck.

No Middle Fees like Brokers

Direct lenders don’t add extra costs that brokers often slip in. Those saved pounds can buy school lunches or bus tickets instead. You see the full cost upfront with no shock fees later. The price you see is what you’ll pay without hidden costs.

Easier to Negotiate Repayment Plans

Direct lenders often bend when life gets hard. You can speak to people when payment dates need shifting. Many offer payment breaks when illness or job changes happen.

Trusted Options for Single Mothers in the UK

The government rules protect you from unfair loan tricks and traps. The lenders grasp the real costs of raising kids here. They know about school terms, winter fuel needs, and housing costs. Many lenders have special plans just for single parents. You can look for the FCA badge to know they follow strict rules.

Conclusion

The way to fair lending is to understand your real value. The lenders look behind the numbers to the good mum. Do not be afraid to make small steps before the day ends by checking your rights and options. You can seek assistance in the initial stages when the small holes can turn into the broad holes.

You are neat with all papers, so you can get ready when you need assistance. Common sense tells you when a loan transaction sounds better than fair. This is the road many mums have trodden and made their way through. The correct loan may be the bridge rather than the concept of straining your shoulders.

Sarah Jones is a seasoned financial writer with over a decade of experience covering personal finance loans, and dedicated to provide the best lending solutions to the clients. Known for translating complex financial topics into accessible insights, Sarah contributes to leading loan providers like Arbitrageloans and contributes to the company’s growth via professional writing and loan guidance. She holds a degree in economics and is passionate about helping aspirants with tools to make informed loan decisions. She also loves to explore the world and its natural beauty. Sarah believes financial literacy is the base of legitimate lending and borrowing. She strives to make it understandable for all.