Finding the proper financial support when you are on benefits becomes necessary. A money crisis occurs more often when you have a weaker income. However, it is impossible to fight financial issues without flexible direct lending solutions. Those who live on benefits and need a loan today from a trusted direct lender. Our online lending service helps you get money the same day.

Arbitrageloans, being a trusted direct lender, offers a wide range of loans for people on benefits with a personal feature. You can apply through a 100% online approach that takes only a few minutes. We understand your urgency, which surely translates to a last-minute serious financial need. This is why, giving importance to the convenience of our customers, we offer a real-time, fast approval decision.

You can manage short-term needs effortlessly through affordable loans for people on benefits from a direct lender. We even encourage our borrowers to make educated conclusions. You can know the approximate interest rate and instalments on a loan amount through a free eligibility check without a hard credit search.

Still thinking? Act before your pending bills dominate your finances and affect your credit rating. Apply now and get a loan with no obligation to regain control of your life and finances. Keep no constraint of purpose while applying. You can even get a home improvement loan by claiming benefits, or for no specific reason..

Loans on benefits is a short term personal loan that available specifically to those living on government benefits. This can be any type of benefit, such as Universal credit, child benefits, unemployment benefits, disability benefits, and state pension.

A person living on such an external financial support needs additional funds to apply for these loans without credit check on benefits. Through a completely online process, the fund seeker can apply for funds, providing relevant details of government benefits.

Applying for a loan while claiming government benefits from direct lenders guarantees hassle-free and speedy access to funds. At Arbitrageloans, we consider earning from benefits as income. Therefore, you can borrow all the details that prove your payback capacity. If there is any other income source, that too can be considered easily for this short-term loan.

The loans for people on benefits are a feature. It means a lender offers all of its loan products while living on government financial benefits. Therefore, the direct lender company offers tailored loan products to those people who are getting benefits and need urgent financial assistance.

As a direct lender, Arbitrage loans give various types of loans for individuals while you live on benefits: -

As per the type of loan, the terms and conditions may differ. You need to keep in touch with us, and we vouch for making the best arrangements as we can.

Loan on benefits for bad credit is particularly tailored for those individuals who have low monthly income, are dependent on government-sponsored benefits, and face trouble with a less-than-perfect credit score. Getting an approval may be difficult, but not impossible. Some specialist online lenders like Arbitrageloans consider your loan request based on your affordability, not only on your credit score.

Here is how these loans work:

Loan Feature |

Justification |

| Affordability | You can get loan approval if you show your ability to repay the amount. This is even with previous defaults, CCJs, and a low credit profile. |

| Loan term and amount | These are typically unsecured short-term loans available up to £5,000 for the maximum duration of 36 months. |

| Income evaluation | Lenders usually go through your total income, including monthly earnings and benefits you are receiving. |

| No guarantor or collateral | These loans usually do not need backup of a guarantor or collateral, but come with higher interest rates. |

How do lenders assess my eligibility?

The loan providers usually consider your eligibility on these factors:

Living on benefits is brave because you manage so many things despite insufficient money in your account. Same day loans for people on benefits solve all your problems with high approval loan solutions.

Several factors help us ensure acceptance to the maximum number of applicants.

Getting a loan on benefits with no guarantor sounds exciting. However, certain factors work behind this comfort, which we follow to ensure fast and budget-friendly lending.

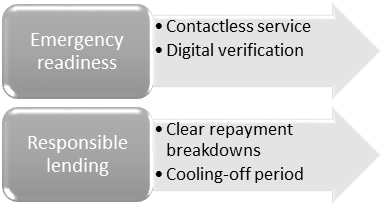

We offer the best borrowing experience if you are on benefits and need a loan today from a direct lender. For that, we make several factors part of our lending policies.