Now you are able to take loans according to how you manage money, rather than your credit score. The lenders look right into your banking history upon seeking your consent. This provides quick decision-making and better rates for most borrowers.

The transformation helps individuals who the past systems have wronged. Your salary, spending habits and bill payments tell your financial story. This guide shows you exactly how these open banking loans work.

What Are Open Banking Loans?

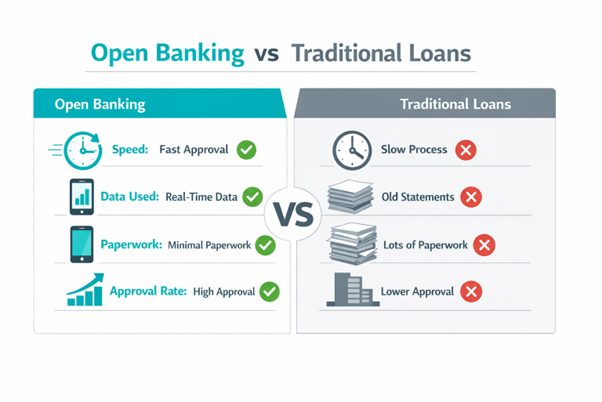

Open banking loans have changed how you borrow money in 2026. These are the loans which access your banking information with your authorisation via private APIs. The lenders observe your income levels, spending patterns, and how you spend your money daily.

You simply give your lender the history of your dealings. This will provide them with a much more accurate appreciation of your finances than the customary credit checks would have done so. It is comparable to submitting the resume of your finances and not just your examination performance.

FCA is very keen on these loans. They are governed by very strict Open Banking laws that protect your information and privacy. The following are the provisions of the PSD2 framework that changed the future of the banking industry, since it allows you to have a say on what is stored about you. You might also have a meagre credit record, but you are brilliantly using your dough each month.

Open banking loans with no credit check aren’t completely credit-blind, but they focus more on your current finances than past mistakes. This approach helps many who have old systems unfairly judged.

How Open Banking Loans Work: Step-by-Step

You must know how open banking works to apply it sooner or more easily:

Step 1: You find a lender that uses open banking and start your application online or through their app. The forms are much shorter than traditional loans since they’ll get most info straight from your bank.

Step 2: The lender asks you to connect your bank account. You’ll see a secure screen where you log in with your normal banking details.

Step 3: You permit read-only access to your transaction history. This means they can see your money movements but can’t touch a penny or make changes to your account.

Step 4: Their system pulls 3-12 months of your banking data in seconds. This shows them your salary payments, regular bills, and spending patterns without you uploading a single statement.

Step 5: The algorithms check your income stability and habits.

Step 6: The system analyses your spending to check affordability. It spots if you’re already stretching your budget too thin or if you have plenty of room for loan repayments.

Step 7: You get a decision much faster than with traditional loans. Some lenders now offer instant decisions 24 hours a day.

Step 8: If approved, you’ll sign your agreement electronically, and funds will arrive in your account the same day or next working day. Some lenders now offer instant payments.

The loans that use open banking speed up the whole process. The old paper chase of bank statements, payslips and utility bills has been replaced by secure data sharing that benefits everyone.

Who Uses Open Banking Loans in 2026?

First-time borrowers can get open banking loans. Your banking data shows lenders that you can handle money responsibly, even without previous loans.

People rebuilding after credit problems use these loans to move forward. The open banking loans for bad credit look at your recent banking behaviour rather than just past mistakes. They see if you’ve turned things around, even if your credit score hasn’t caught up yet.

The freelancers and gig workers finally get a fair shake with these loans. Your irregular income patterns that scared traditional lenders become completely visible through open banking. The lenders see that while your income varies, you’re still a solid bet for repayment.

Small business owners find open banking loans perfect for quick cash flow fixes. Your business bank account tells the story of your company’s health. The lenders can spot seasonal patterns and understand your true repayment ability. One can also take open banking loans from a direct lender. They can also have money in your account the same day you apply.

Is Open Banking Safe and Secure?

Open banking loans follow through with your data safety. The FCA very strictly supervises this entire system. Your banking data can only be accessed by hard-to-break security standards by all the providers.

The information is bank-level encrypted throughout. The same protection that protects your online banking information so that it is safe when it is disclosed to lenders. They can’t withdraw funds, make payments, or change anything in your account. They simply get a window into your transaction history for assessment purposes.

You stay in control of your data at all times. You must actively grant permission before any lender can peek at your financial information. Nothing happens automatically or without your say-so.

- You can cut off access whenever you want through your bank’s app

- The lender never stores your banking login details

- The connection happens through regulated third-party providers

- Most lenders only need a one-time look at your data, not ongoing access

- The system was built from the ground up with privacy as a priority

Conclusion

Open banking loans mark a turning point in how you borrow money. The ancient days of long forms, paper statements and days of waiting are all disappearing. You always control your data. This comes at your discretion, and you can make or end access whenever you like using your banking app. The system puts you in charge.

FAQs

Can I get an open banking loan with no bank account?

No, you will have to have at least one running bank account. It operates based on the review of your banking information. And in case you do not already have a bank account, open one.

Will using open banking loans affect my credit score?

The usage will not hurt your credit score, as most lenders make initial soft searches. Assuming you borrow and pay on time, your rating will probably increase.

How long does my banking data stay visible to lenders?

The lenders will only have temporary access. You have to allow them to continue watching your account. The majority of them just require a single glance at 3-12 months of the past.

Can I use open banking loans if I have multiple bank accounts?

Yes, and it usually does you no service. You will be able to add all the accounts that you attend to regularly to display your financial image. The lenders should be able to view them all to know how you can divide your income among a number of accounts.

Sarah Jones is a seasoned financial writer with over a decade of experience covering personal finance loans, and dedicated to provide the best lending solutions to the clients. Known for translating complex financial topics into accessible insights, Sarah contributes to leading loan providers like Arbitrageloans and contributes to the company’s growth via professional writing and loan guidance. She holds a degree in economics and is passionate about helping aspirants with tools to make informed loan decisions. She also loves to explore the world and its natural beauty. Sarah believes financial literacy is the base of legitimate lending and borrowing. She strives to make it understandable for all.