Does unemployment affect your credit file? Not really. But, not having a fixed income does affect your ability to repay the credit cards, utility bills and rent.

These non-repayments get recorded on your credit report and affect your credit score. Thus, taking immediate action when you get unemployed is important.

The blog explains how credit file works and what actually affects them during unemployment, and the practical steps that you can take to protect your credit file while unemployed.

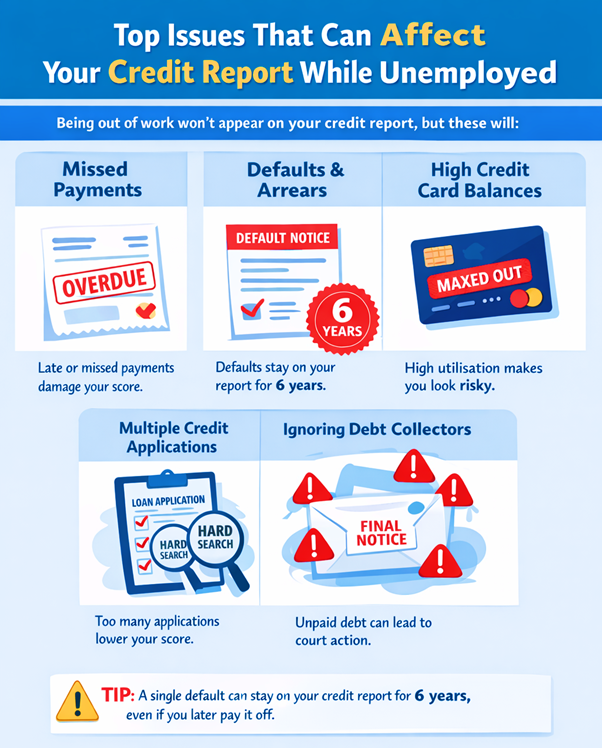

What damages your credit profile as an unemployed person?

Here are some aspects that may affect your credit score even if you don’t work. The following table states the aspects and how highly they impact the credit score:

| Risk Factor | Impact on credit file | Severity |

| Missed payments | Late markers, arrears | High |

| Loan defaults | Damages score for 6 years | Very high |

| High credit utilisation | Lowers score | Medium |

| Multiple credit applications | Signals financial stress | medium |

| Ignoring loan providers | Escalates to loan default | Very High |

| Buy Now and Pay Later missed payments. | Increasingly reported | Medium-high |

As you can see, Buy Now and Pay Later aspects like credit cards and overdrafts get reported the most; check alternatives. Or else, it may affect your credit profile and repayment ability drastically. Thus, analyse the use of loans for people on benefits for your requirements.

These are affordable than credit cards and offer flexible terms. You may use it if you have an urgent need and receive a benefits payment from the government. Although the amount stays low, it is sufficient to counter small cash emergencies like medical requirements.

Steps to prevent your credit report from being out of job

Here are some steps to follow to protect your credit profile during unemployment. You cannot do much about non-repayments unless the financial situation improves. However, you can still prevent significant damage. Here is how:

Step 1- Audit your credit profile

Identify the outdated balances, paid debts, errors and delinquencies in your credit report. Analyse and report the wrongly listed payments, paid debts and other wrong information.

It may take time to receive your updated credit report. However, doing so early improves your credit score. It may help you check on some loans to counter emergencies.

Here is what you must check as a process:

- Payment status

- Linked addresses

- Default notices

- Financial association

- Old accounts that are no longer operational. You must close these.

Prioritise the payments

It is important to make a minimum payment on each due date, even if you are unemployed. Otherwise, the total interest and dues may surprisingly burst your basic budget.

| Priority level | Examples | Credit Impact if missed |

| Essential living costs | Rent, council tax and utilities | Indirect (poses legal risk), like a rental eviction |

| Priority debts | Council tax arrears, HMRC | Legal enforcement |

| Credit commitments | Loans and credit cards | Direct credit damage |

| Subscription | Streaming, gyms, OTTs | No credit impact |

| By now, pay later | Clearpay, Klarna | Reported increasingly. |

Thus, you must take the following actions:

- Negotiate the rental bill with the landlord.

- Write a letter to HMRC explaining why you cannot pay taxes

- Check the possibilities of rescheduling loan payments with the creditor

- Reduce usage of Buy Now Pay Later aspects

- Curtail your living budget to just essential costs. Avoid any Ott subscriptions.

Step 3- contact creditors early

It is always better to connect early to avoid the devastating scenarios. What if you approach the last date of the bill and you cannot pay? It may lead to massive penalties, high interest rates, and disrupt financial well-being.

They may agree to negotiate the terms as they need their money back. So, you may benefit from”

- Payment holidays- In this period, you don’t need to pay the monthly instalments

- Fetch a new payment plan- The new plan is according to your current affordability and budget

- Freezes interest- you just need to pay the principal amount for some time

Thus, these aspects may help you protect your financial well-being. It gives you enough opportunity to work on your finances and grab a good job. However, the debts stay on your credit report. It does not go away unless you pay it in full.

Step 4- Avoid tapping costly payment options

You must watch your finances if you are on a debt repayment plan or are unemployed. Tapping costly payment options like credit cards, Buy Now Pay Later schemes, and overdrafts affects your ability to pay on current debts. It thus may lead to a debt-trap funnel. Instead, you must re-plan your budget and stick to what matters to you the most now. Alternatively, compare all financial options before choosing these easy-to-access aspects.

For example, Most individuals use Klarna for purchasing big-ticket items. However, the interest rates stay high, like 21.9%-35.99%. It depends on the credit, the purchase made and the specific payment plan. It means you pay more than what the item actually costs. It is thus better to search for alternative options like Unsecured Loans for Bad Credit with no guarantor Required. The interest rates stay 5.8% – 29.9%.

It helps you meet your requirements with better rates, better payment options and flexibility. Moreover, you don’t even need a third person to help you with a purchase as an unemployed person. Instead, you may get the loan based on your current affordability. Identify how much you can comfortably pay on the loan. Align it with the cash requirements and get the one with the lowest interest rate possible. The unsecured loan gives you the upper hand in dominating the repayments. You can halt it if you cannot pay due to a sudden financial issue. It would not enter default. Precisely, with loans, you share the flexibility to intervene and get a new payment schedule. However, you cannot do so with Klarna. If you try, it may lead to account restriction, high fees and may even affect the credit score.

Step 5- Use benefits and support safely

Lastly, avoid using benefits for unnecessary aspects. Instead, identify the cash needs, check the savings and urgency level. Avoid tapping small loans for unnecessary reasons. Although these are not reported on your credit report, they affect your finances. What if you use it for something unnecessary and actually need it the next moment for a critical emergency? Therefore, prioritise savings. Check loans for people with CCJ

Bottom line

These are some ways to protect your credit file when you are out of work. Analyse the aspects that may hamper your credit score unless you get a new job. Work on it and seek negotiation on loan payments, credit card dues and rent. Identify the ways to reschedule payments and get an affordable payment plan. Check whether you can halt the payments or pay just the principal amount for a while?

Sarah Jones is a seasoned financial writer with over a decade of experience covering personal finance loans, and dedicated to provide the best lending solutions to the clients. Known for translating complex financial topics into accessible insights, Sarah contributes to leading loan providers like Arbitrageloans and contributes to the company’s growth via professional writing and loan guidance. She holds a degree in economics and is passionate about helping aspirants with tools to make informed loan decisions. She also loves to explore the world and its natural beauty. Sarah believes financial literacy is the base of legitimate lending and borrowing. She strives to make it understandable for all.